The Benefits

Trading 24/7, no effort required and no knowledge required! We take great care in developing our bots to ensure our users can enjoy the benefits from automated trading without stress and worries. We only benefit if our users benefit.

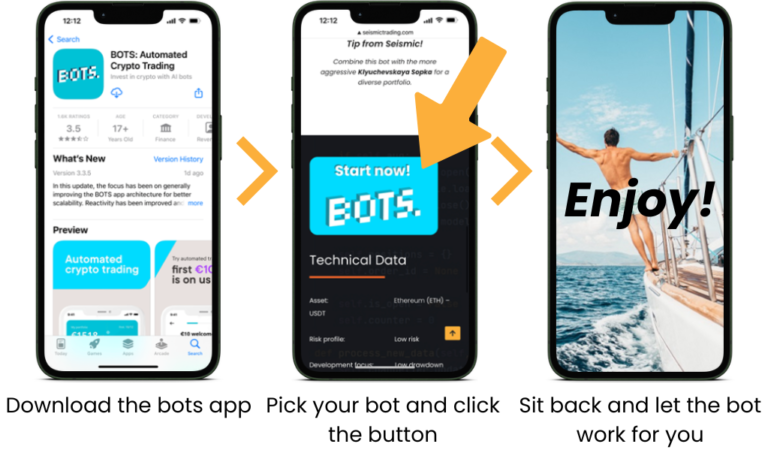

Are you still investing manually or are you unsure how to invest in cryptocurrencies? USE BOTS! Bots are digital robots that perform automated trading. No effort required, just start the bot and let it do all the work for you.

The bots use their integrated strategy to determine if the market conditions meet the requirements to open and close trades. After the bot is activated, it will continue to invest for you until you tell it to stop.

Trading 24/7, no effort required and no knowledge required! We take great care in developing our bots to ensure our users can enjoy the benefits from automated trading without stress and worries. We only benefit if our users benefit.

We provide the experience and expertise, you get the benefit.

The trading algorithm does all the work for you, 24/7.

All our trading algorithms have passed our rigorous tests before being published.

We only benefit if our customers benefit, and our customers only stay with us if we do our job correctly.

Most people have heard about “Bitcoin, Ethereum, crypto, cryptocurrencies, blockchain”, but what are they really?

A cryptocurrency (also referred to as “crypto”) is a digital currency, which is an alternative form of payment created using encryption algorithms. The use of encryption technologies means that cryptocurrencies function both as a currency and as a virtual accounting system.

Cryptocurrencies don’t have a central issuing or regulating authority, instead using a decentralized system to record transactions and issue new units. This system is called the blockchain and every cryptocurrency has it’s own blockchain.

The biggest cryptocurrencies are Bitcoin and Ethereum. They have seen growth of up to 1300% over the last 10 years. This explosive growth makes cryptocurrencies a very interesting option for investing.

However, it should be noted that cryptocurrencies are volatile. Meaning, values of cryptocurrencies fluctuate strongly, up and down. The volatile nature means cryptocurrencies have incredible potential gains. It also means that there is no guarantee and investors should be aware that there is always a risk involved when investing in cryptocurrencies.

Select a trading algorithm with a profile that matches your investment goals.

Every type of investing carries risk, so we strongly advice to invest with caution and to only invest surplus capital!

A trading algorithm uses an underlying strategy to determine its actions. It enters a trade when the market conditions meet the strategy’s specific requirements. It will exit a trade when the market conditions are no longer beneficial for the strategy.

Each algorithm is programmed for a specific investment strategy with a specific risk profile.

The passive algorithms like to play it safe and wait for the market conditions to perfectly match the strategies perfect setup. They are considered low risk.

The more aggressive algorithms take more chances and are less strict in waiting for the perfect setup, resulting in more trades. The are considered high risk

Because different algorithms have different investment- and risk- profiles, it’s important to select an algorithm with a profile that best suits your goals and needs.

We have 3 main strategy profiles, click on them to learn what they are and how they work :

The algorithm only acts on the best setups. If a trade starts to lose, the algorithm will shut the trade down quickly to minimize losses.

Like the previous category, these algorithms only trade the best setups. However, this strategy allows for more margin to recover when the algorithm is in a trade. This results in higher success rates.

These algorithms are the most aggressive ones. They'll not only trade the perfect setup, but good setups as well. This results in more trades and therefore a higher return potential.

Feel free to send us an email, we are happy to help!

Our strategies are developed based on the experience of experienced traders. Next, the strategies are extensively tested. We only approve a strategy for use if it passed all tests.

To ensure a strategy works as intended, we test it thoroughly. We test its performance and all of its functions. The tests are based on historical performance and proper current function.

To check its historical performance we test the strategy by checking it’s performance on historical market data. This way we ensure it would’ve performed as expected and we learn about its strengths and weaknesses. We perform these backtests based on exagerated fees to ensure a conservative estimate. You can review the backtest results on the our botpages.

To check its current function, the strategy is put into a test environment that uses current market data. Here we check if the bot executes its strategy in the way we intended it to do.

We are happy to provide you with all the information you need to get the best start for your automated trading journey!