Hope Fault

Hope Fault is a great pick if you are looking for a low risk Bitcoin strategy with low drawdown!

Introduction

Hope Fault is an active transform fault that runs in a nearly straight line for about 230 kilometers. It is located in the northeastern part of South Island, New Zealand. Hope Fault is an active but not aggressive fault, its tectonic plates are constantly moving at a slower pace. Like the fault we named it after, our trading bot is active but not too aggressive.

Identity

Hope Fault is designed with a focus on limiting drawdown. It is less aggressive than other strategies to reduce risk. The low aggression combined with the low drawdown, means that Hope Fault will wait for the best opportunities to trade and will have a lower amount of trades. It also means that Hope Fault will cut losses quickly if the market moves in an unexpected direction. Trading the biggest cryptomarket, Bitcoin (BTC), this strategy benefits from relatively stable markets which creates less risk. Because of these characteristics Hope Fault is an excellent low risk strategy.

Strategy

When markets get close to their (temporary) bottoms after a strong decline, they frequently display a very specific pattern, the Enigma indicator. Hope Fault is looking for a fast and strong recovery. After the bot identifies this behaviour in the market, it confirms if the conditions are right for buying by using our proprietary price based indicator, the Myopic. After these pricedips, prices will generally increase for a period. Because the length of this period is impossible to determine, Hope Fault closes the position when the increase of price slows down to protect the profit. Hope Fault is set up to be restrictive in both the Enigma and Myopic indicators, resulting in a less aggressive trading profile. On top of this, Hope Fault is set up to be more restrictive for negative margins, meaning the bot will close a trade quicker if it becomes negative. So if the trade turns out negative, Hope Fault makes sure the losses are limited.

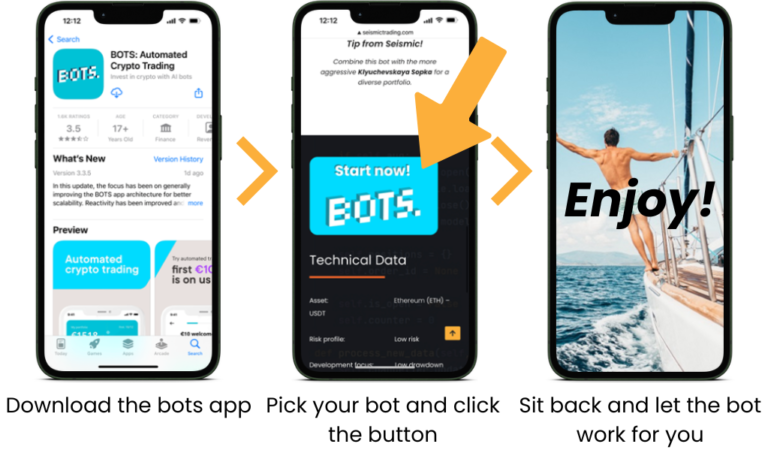

All Seismic trading bots are available on bots.io. To start your investing jouney all you have to do is: