Etna

Etna is a great pick if you are looking for a low risk Ethereum strategy with low drawdown!

Introduction

Mount Etna, or simply Etna, is located on the east coast of Sicily and is the tallest and one of the most active volcanoes in Europe. According to both Greek and Roman mythology, the god Vulcan/Hephaestus had his blacksmithing forge under mount Etna. Like the volcano we named it after, our trading bot is always active and busy forging solid returns.

Identity

Etna is designed with a focus on limiting drawdown. It is less aggressive than other strategies to reduce risk. The low aggression combined with the low drawdown, means that Etna will wait for the best opportunities to trade and will have a lower amount of trades. It also means that Etna will cut losses quickly if the market moves in an unexpected direction. With the Ethereum market generally experiencing strong up- and downswings compared to Bitcoin, Etna gets plenty of opportunities to trade. Because of these characteristics, Etna is an excellent low risk strategy.

Strategy

When markets get close to their (temporary) bottoms after a strong decline, they frequently display a very specific pattern, the Enigma indicator. Etna is looking for a fast and strong recovery. After the bot identifies this behaviour in the market, it confirms if the conditions are right for buying by using our proprietary price based indicator, the Myopic. After these pricedips, prices will generally increase for a period. Because the length of this period is impossible to determine, Etna closes the position when the increase of price slows down to protect the profit. Etna is set up to be restrictive in both the Enigma and Myopic indicators, resulting in a less aggressive trading profile. On top of this, Etna is set up to be more restrictive for negative margins, meaning the bot will close a trade quicker if it becomes negative. So if the trade turns out negative, Etna makes sure the losses are limited.

Tip from Seismic!

Combine this bot with the more aggressive Klyuchevskaya Sopka for a diverse portfolio.

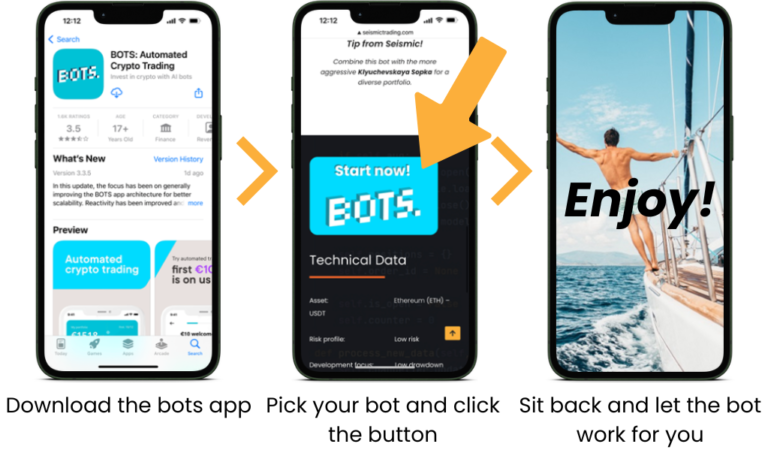

All Seismic trading bots are available on bots.io. To start your investing jouney all you have to do is: