Seismic bots

Different bots for different goals

Each bot has a different strategy and risk profile. Some bots are conservative, others are more adventurous.

The bots are divided in 3 main strategy classes. Make sure to select the bot that best matches your investment goals.

If your goal is steady low risk return on investment, your best choice is a bot that matches that description like the low risk low drawdown bots and the low risk high success rate bots.

If your goal is to get the highest possible return, your best choice are the high risk high return bots.

Click on the bots below to learn more about their background and strategy.

High risk, high return bots

High risk high return algorithms are the most aggressive ones. They’ll not only trade the perfect setup, but good setups as well. This results in more trades and therefore a higher return potential.

Low risk, high success rate bots

Low risk high sucess rate algorithms only trade the best setups. However, these strategies allow for more margin to recover when the algorithm is in a trade. This results in higher success rates.

Low risk, low drawdown bots

Low risk low drawdown algorithms only act on the best setups.

If a trade starts to lose, the algorithm will shut the trade down quickly to minimize losses.

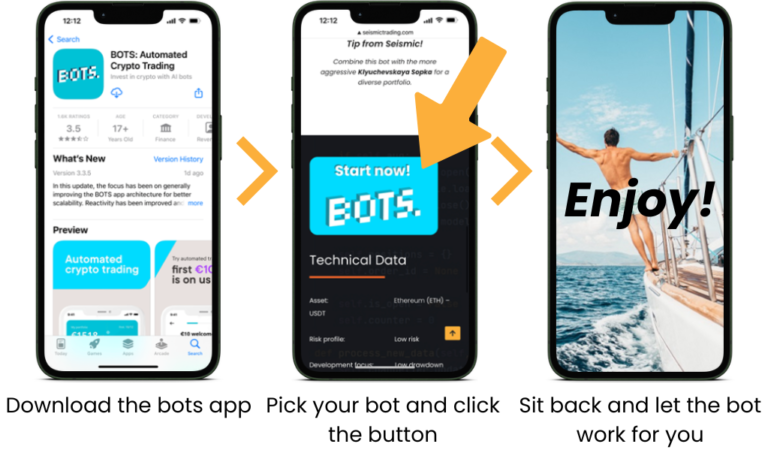

All Seismic trading bots are available on bots.io. To start your investing jouney all you have to do is: